FIA

Is your retirement nest egg protected from downside market risk?

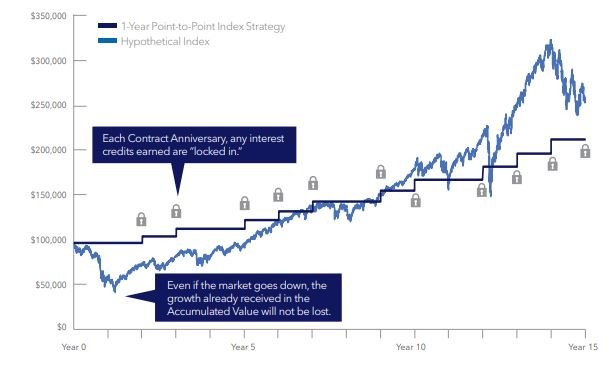

The closer you get to retirement, the more important it is to protect what you have worked so hard for. Money invested in the stock market can be subject to unpredictable swings up and down, bull or bear. Volatile markets can have a significant impact on retirement income. Is it possible to limit your exposure to volatile markets but still grow your nest egg?

An Fixed Indexed Annuity (FIA) may be your answer

With a fixed indexed annuity, you never have to worry about losing money due to a market downturn. You are not investing directly in the stock market. Instead, you have the opportunity to earn interest credits based on the upward movement of a market index, like the S&P 500. And guarantees built into the annuity assure that you’ll never receive less than zero interest credits.

Direct Market Investment

What goes up, may come down

Investing in the market gives you unlimited growth potential, but also the risk of loss if the market turns down. Are you willing to take that risk?

Fixed Indexed Annuity

It’s what you keep that counts

In exchange for this guarantee, FIAs limit the the amount of interest credits you can receive. But any interest credits you earn are “locked in” and cannot be lost even if the market goes down.

Zero is your hero!

A FIA is an insurance product that guarantees your money will not be lost due to market downturns. You will never receive less than zero percent interest in any crediting period.